Self Funded Healthcare Benefit Feasibility

Is a knowledge gap impacting how competitive you are in your proposal efforts? KNOW YOUR OPTIONS. Get educated or work with someone who knows.

At Keystone Benefit Group, our philosophy is simple:

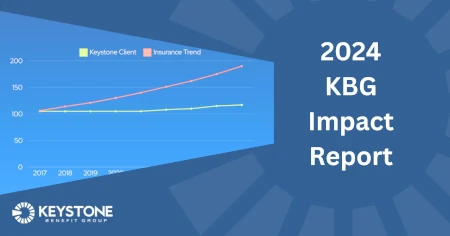

💰 Insurance companies refer to your premium as “revenue” and no company ever wants to decrease revenue.

❓ Self-funding might not make sense for every one, but it’s imperative to evaluate its feasibility.

⏱ If you wait for a bad renewal to explore self-funding, it might be too late. Take advantage of good claims years to mitigate future transferable risk.

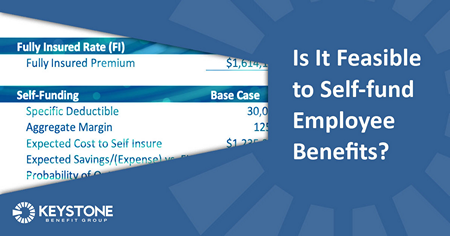

In this video, Mike DeVaux briefly covers a self-funded feasibility study for a Government Contractor with 88 employees. The *maximum* liability to the employer was considerably less than the expense of a fully-insured plan.

The group not understanding self-funding and not moving off fully-insured program was costing over $4,000 per employee and actually impacting their competitive nature within their proposal efforts. Without question, this group was going to save at a minimum 220,000 by understanding their options within the healthcare continuum and going self-funded.

The goal here is know your options and if you don’t understand what your options are, you need to get educated or work with somebody that does.

I would love to hear your feedback and how you are handling this emerging trend in healthcare! We are here to help with all your employee benefit questions, please contact us anytime, our experts are ready to talk.