Federal Contractors, don’t let your benefit program be a “Fire & Forget”

A blog from the desk of our CEO, Mike deVaux.

A blog from the desk of our CEO, Mike deVaux.

Fire & Forget is a type of missile that will find its target without any guidance after launch. Fire & Forget works great for some weapons, but not so much with benefits. Is your benefit program a “Fire & Forget” program that you launch once a year and don’t look at again until your next renewal?

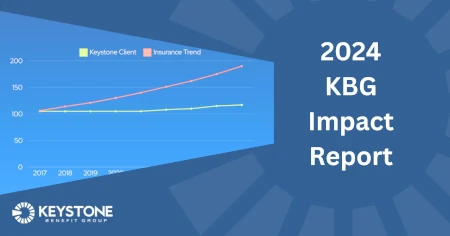

This time of year, most companies enter the benefit renewal season, but unfortunately for many companies and their employees, this is the only time of year they focus on their benefit programs. How are their plans performing, how much they spend on benefits, what is their contribution strategy?

I have a good friend, a CEO of a large hotel chain, who calls this time of year the “September Surprise”. A time when his benefit consultants tell him how much the costs were going up on their plan. It is the one time a year they discuss the plan’s true performance. Your benefit renewal should never be a surprise and the renewal discussion should not be the first and only time you talk to your broker or consultants during the year. If it is, you need to do what my CEO friend did and find a new consultant.

Plans typically fall into three main categories:

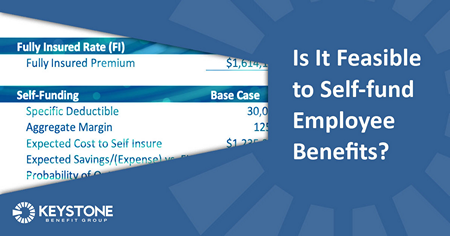

Self-Funded Plans: A plan where the employer assumes the financial risk of healthcare and pays actual claims of their employees. Typically, an insurance company or third party manages the payments, but the employer is the one who pays the claims.

- There is no excuse not to know how your plan is performing. You and/or your benefit consultants have access to your claims information and performance at all times.

- Insurance markets have shifted after the Affordable Care Act to provide self-funded insurance products for smaller employers. This affords them many of the advantages found in self-funded plans at large companies but with the certainty of monthly funding.

Note: Insurance market have shifted to provide self-funded programs for smaller employers to allow them to take advantage of all the positive aspects of self-funding. They may not have all the options and features of a large self-funded plan, but positions companies to reduce their medical insurance spend if their utilization runs well.

Fully-Insured Plan: A plan where the employer pays a certain amount each month (the premium) to the health insurance company. In return, the insurance company covers the costs of the employees’ healthcare.

- Large fully insured plans do receive some claims information, but the information is less than what is provided to self-funded plans and is usually delayed in when it is reported.

- For small employers, it is a little harder to get information during the year to assess plan performance. You stay informed about demographic changes which is typically the main driver of your benefit renewal.

Here are a couple recommendations to ensure your benefit program is not a “Fire & Forget”:

- Demand that you have quarterly calls with your consultants to discuss your plans performance.

- If you are on a fully insured medical plan, ask your consultants to assess if a self-funded plan makes sense for your company. Self-funding provides information that just isn’t provided by fully insured plans, and rewards companies that manage their claims spend well.

- Understand how your costs structure impacts your “Price to Win” Strategy for your proposal efforts, your bottom-line profit and don’t only do this at renewal time.

- Understand how your benefits compare to the competition. Remember to compare against other companies working in federal contracting and not companies in your same field or size category. Government contractors tend to have better benefits

- If your consultants can’t or won’t provide you these things, go find a new consultant.

I know that benefits aren’t sexy like other decisions government contracting faces, but they are an essential part of any government contractor’s success. If you are a services company in federal contracting, benefits are your number 2 or number 3 expense behind payroll. How you handle this large budget item will have a tremendous impact on your long-term success.